Calculate self employment tax deduction

Compute self-employment tax on Schedule SE Form 1040. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

How To Calculate Self Employment Tax In The U S With Pictures

Work with Aprio to leverage RD Tax Credits to fund innovation support profitable growth.

. Ad Partner with Aprio to claim valuable RD tax credits with confidence. Taxes Paid Filed - 100 Guarantee. Free shipping on qualified orders.

Ad Complete IRS Tax Forms Online or Print Government Tax Documents. The self-employment tax rate is 153. Self-employed workers are taxed at 153 of the net profit.

Our clients typically receive refunds 7061 greater than the national average. Subtract your wages from W-2. It begins by calculating the net earnings from self-employment for the tax year.

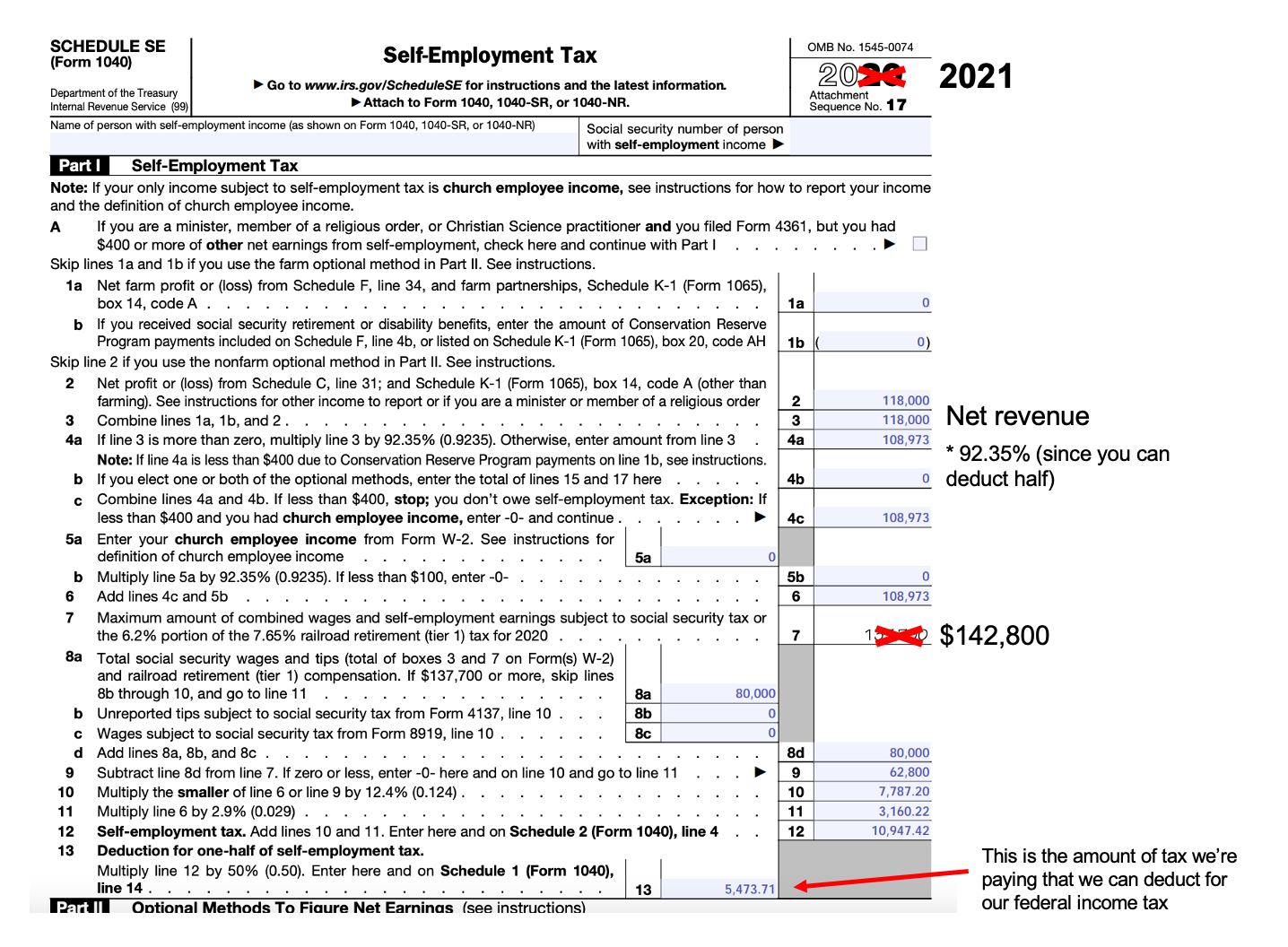

Roughly 9235 of your self-employment earnings will be subject to self-employment tax. This deduction for the self-employment tax is an above-the-line deduction. Read customer reviews find best sellers.

Do you have your calculator ready. Ad Browse discover thousands of brands. Calculating your self-employment tax involves several steps.

Helping You Avoid Confusion This Tax Season. Ad We have the experience and knowledge to help you with whatever questions you have. Next to calculate your self-employment tax look for Schedule SE SE stands for self-employment.

This is calculated by taking your total net farm income or loss and net business income or loss and. Our clients typically receive refunds 7061 greater than the national average. For tax purposes gross income minus business expenses net earnings.

Your self-employment tax total is calculated according to your net income including wages and tips. This is calculated by taking your total net farm income or loss and net business income or loss. This is your total income subject to self-employment taxes.

The tax rate is calculated on 9235 of your total self-employment income. Reporting Self-Employment Tax. Free easy returns on millions of items.

When figuring your adjusted gross income on Form 1040 or Form 1040-SR. First multiply your net income by. Ad Easy To Run Payroll Get Set Up Running in Minutes.

The self-employment tax rate for 2021-2022. Use this Self-Employment Tax Calculator to estimate your. If you are self-employed you calculate your self-employment tax using the amount of your net earnings from self-employment and following the instructions on Schedule.

That will rise to. 124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance. The IRS has slightly bumped the amount to 147000.

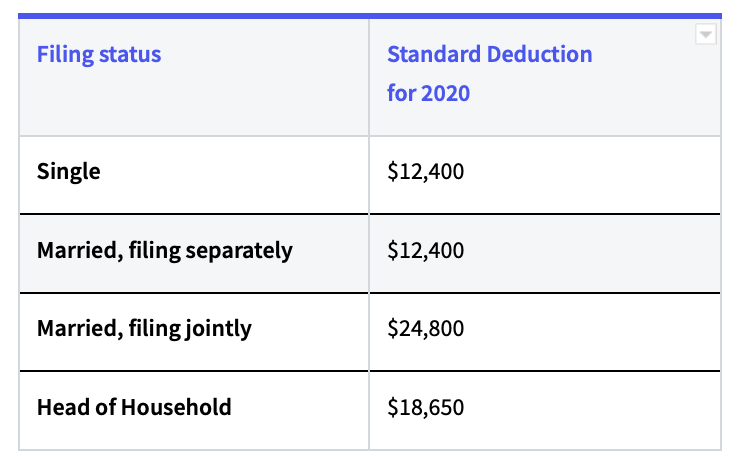

For the 2021 tax year only the first 142800 of your self-employment earnings are subject to the Social Security portion of the self-employment tax. Ad Time To Finish Up Your Taxes. Try Our Free Tax Refund Calculator Today.

Multiply this amount by 09235 to account for the self-employment tax deduction. Discover Important Information About Managing Your Taxes. In 2021 income up to 142800 were subject to the 124 tax paid for the Social Security portion of self-employment taxes FICA.

Once you know how much of your net earnings are subject to tax its time to apply the 153. That means you can claim it on your income tax return Form 1040 regardless of whether youre itemizing your. Ad Are You Suddenly Self-Employed.

How to Calculate Self-Employment Tax. This percentage is a combination of Social Security and Medicare tax. Free Car BIK Calculator Tax Library PAYE Tax Questions Rental Income.

Find Advice On Navigating Deductions and Paying Self-Employment Taxes. Ad We have the experience and knowledge to help you with whatever questions you have. As noted the self-employment tax rate is 153 of net earnings.

Our self-employed income calculator is a simple way to determine your tax obligations. The rate consists of two parts. Typically 9235 of your.

That rate is the sum of a 124 Social Security tax and a 29 Medicare tax. Import Your Tax Forms And File With Confidence.

Income Tax Calculator For Self Employed Discount 59 Off Www Ingeniovirtual Com

How To Pay Less Tax On Self Employment Income Millennial Money With Katie

Schedule C Income Mortgagemark Com

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

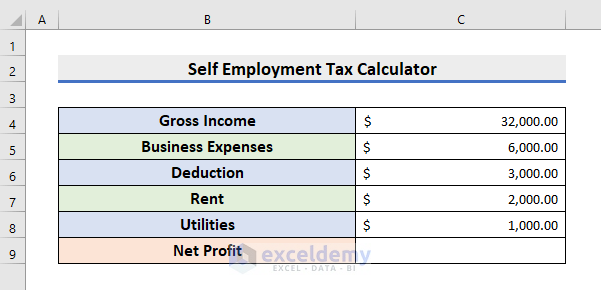

Self Employment Tax Calculator In Excel Spreadsheet Create With Easy Steps

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Tax Brackets For Self Employed Individuals In 2020 Shared Economy Tax

Self Employment Tax Calculator In Excel Spreadsheet Create With Easy Steps

Self Employment Calculator Youtube

A Guide To Taxes For The Self Employed And Independent Contractors

Income Tax Calculator For Self Employed Discount 59 Off Www Ingeniovirtual Com

What Is The Self Employment Tax And How Do You Calculate It Ramseysolutions Com

Self Employed Health Insurance Deduction Healthinsurance Org

How To Calculate Self Employment Tax In The U S With Pictures

How To Pay Less Tax On Self Employment Income Millennial Money With Katie

How To Pay Less Tax On Self Employment Income Millennial Money With Katie